How much can you borrow from Savvy?

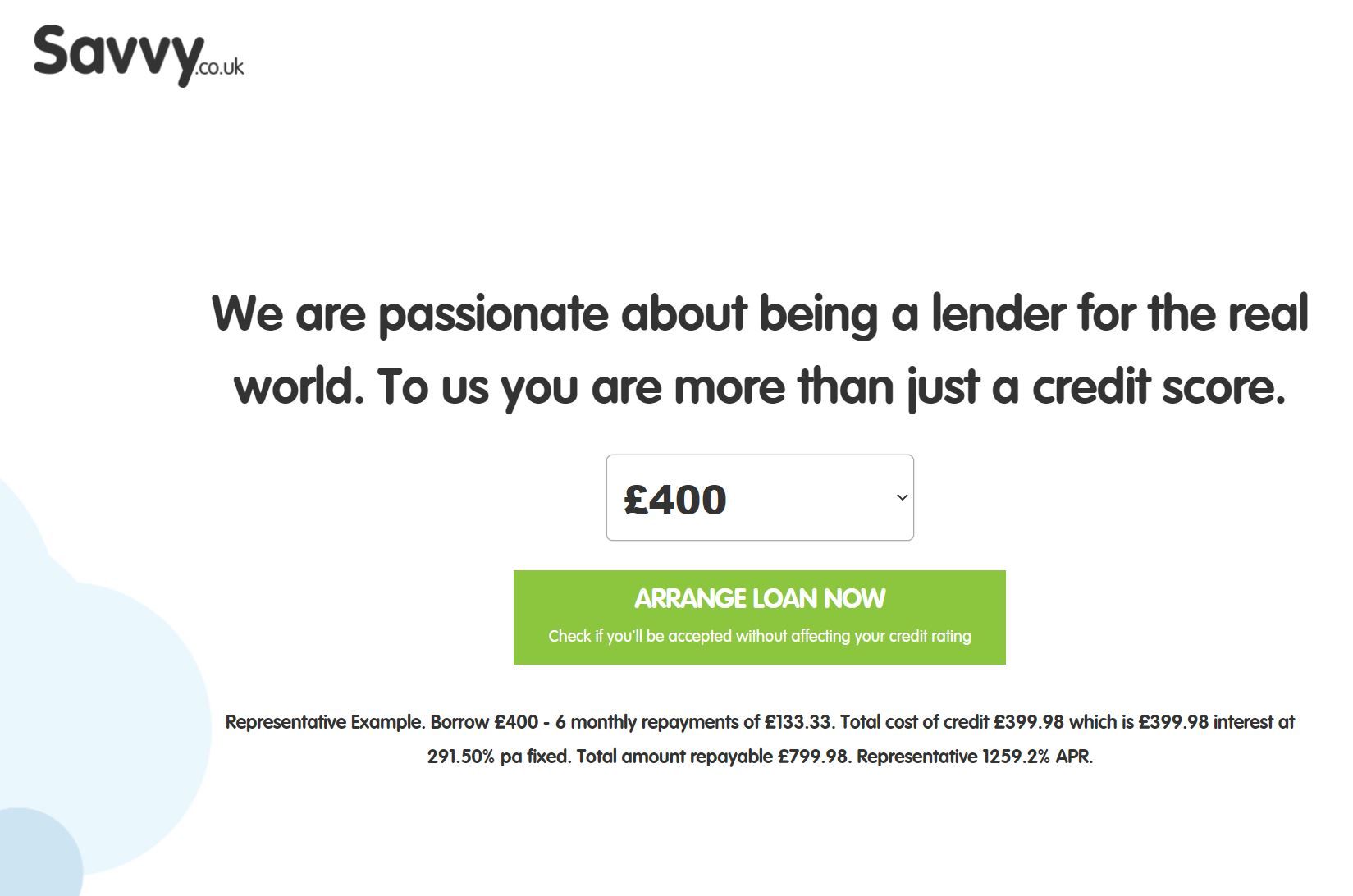

You can apply for a loan Loans between £300 and £1,200.

What rates will customers have to pay?

The interest rate you will pay depends on how much money you wish to borrow:

- For amounts from £300 - £500 inclusive, the representative APR would be 1289.1%

- For amounts from £501 - £700 inclusive, the representative APR would be 728.9%

- For amounts from £701 - £900 inclusive, the representative APR would be 464.1%

- For amounts from £901 - £1,200 inclusive, the representative APR would be 338.2%

How long do you have to repay?

Savvy's loan terms range from between 6, 8, 10 and 12 months depending on the amount borrowed.

Amounts between £300 and £500 are lent over 6 months, amounts between £501 and £700 are lent over 8 months, amounts from £701 - £900 are lent over 10 months, and amounts from £901 - £1,200 are lent over 12 months.

Can you repay a Savvy loan early?

Yes this is possible. You will need to contact the customer service team (details below) and they will arrange for a settlement figure to be given to you in writing. This may also include additional fees and/or interest.

How easy is it to apply for a Savvy loan?

Before applying there are some minimum requirements that need to be met. Ensure you are:

- Aged 18 or over

- A current UK resident

- In possession of an active UK account and debit card

- Receiving an income of at least £1,000 per month

Applications for a Savvy loan are made via their website. They will ask for details such as employer information, bank and card details and three years of address history. Savvy will also require details about your incomings and outgoings. This involves providing things such as pay slips and bank statements that will enable them to run affordability checks.

Do Savvy transfer the money on the same day?

Savvy say they will transfer the funds to your bank account within an hour of approval during working hours.

What’s the best way to reach Savvy’s customer service team?

You can contact the Savvy customer care team on 0330 002 0118.

Is there an online account provided?

If you are successful with your application you will be given login details for an online account.

Do Savvy have an app?

At present there is no app available for customers to use.

How do other customers rate Savvy?

Based on ratings up to and including November 2024, Savvy’s rating on Trustpilot stands at 4.3/5 based on 1,044 reviews.

Are Savvy regulated by any governing bodies?

Savvy are authorised and regulated by the Financial Conduct Authority (FCA) and you can find full details on their FCA register page. They have been authorised since 11/8/16 and are a trading name for Valour Finance Limited.

Savvy summary

Savvy are a respected, award-winning direct lender. Applicants can apply for loans from between £300 and £1,200. The representative APR varies between 338.2% and 1291.1% depending on the amount borrowed.

Loans can be repayed over 6, 8, 10 or 12 months depending on the amount borrowed.

You can apply to repay the loan early, which will require the payment of a settlement figure which many include additional fees and/or interest.

Before applying for a Savvy loan, ensure you:

- Are at least 18-years-old

- Qualify as a legal UK resident

- Have access to an active bank account and debit card

- Receive an income of at least £1,000 per month

There is no app available but customers do have their own online account.

Customer reviews on Trust Pilot give Savvy a rating of (4.3/5), based on figures available up until November 2024.

Savvy have been fully authorised & regulated by the FCA since 11/8/16.

CashLady Representative 79.5% APR