What type of loans are available with Creditspring?

Creditspring have a unique offering for their customers which allows them to access two loans per year, entirely interest free, as a benefit of being a Creditspring member. Each of the loans must be repaid over a six-month period.

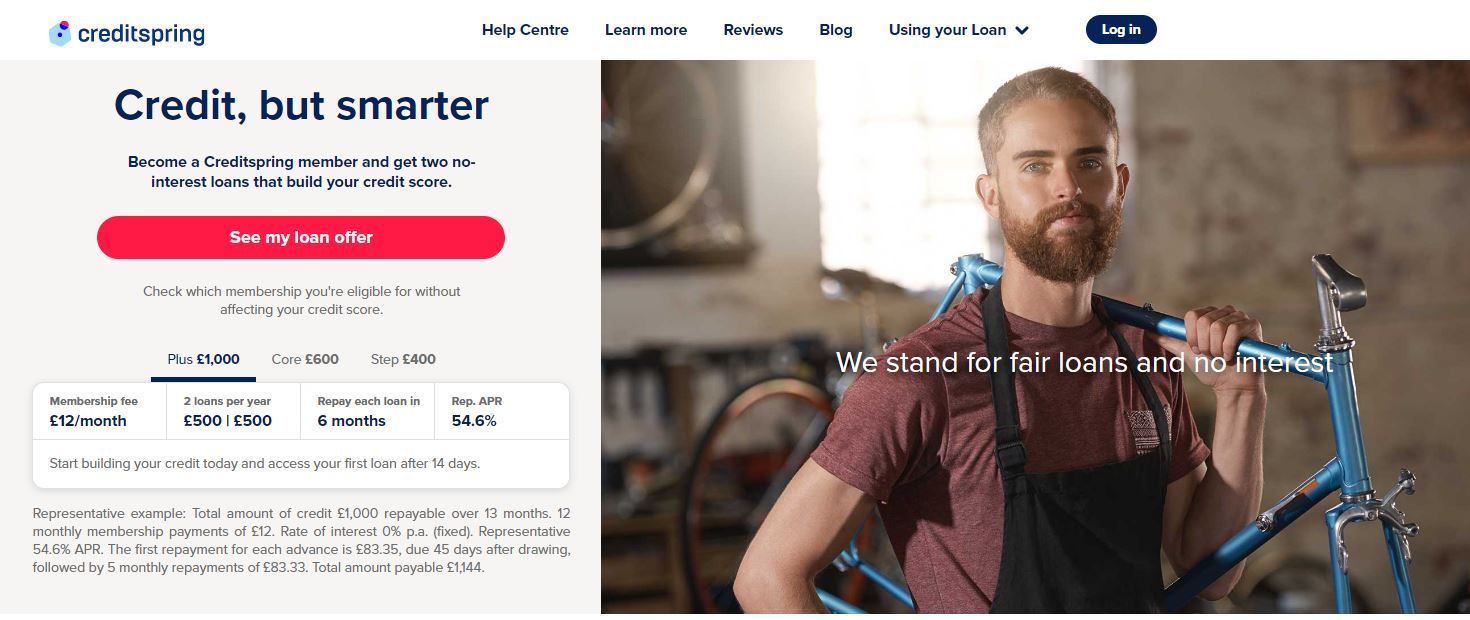

Creditspring customers pay a monthly membership fee which varies dependent on the chosen tier. The membership tier defines how much can be borrowed each year. This is illustrated below:

- Step Membership: £7 monthly fee. Borrow 2 x £200 loans per year.

- Core Membership: £10 monthly fee. Borrow 2 x £300 loans per year.

- Plus Membership: £14 monthly fee. Borrow 2 x £500 loans per year.

- Extra Membership: £26 monthly fee. Borrow 2 x £1,200 loans per year.

How much interest do Creditspring charge?

Each of the two loans per year offered by Creditspring are interest-free. However, Creditspring customers must also pay a monthly membership fee on top of any loan repayments due.

This means that Creditspring’s Annual Percentage Rate (APR) is as follows:

- Step Membership: Representative 88.8% APR

- Core Membership: Representative 83.1% APR

- Plus Membership: Representative 66.2% APR

- Extra Membership: Representative 48.1% APR

Creditspring representative example: Total amount of credit £600 repayable. 12 monthly membership fees of £10. Rate of interest 0% p.a. (fixed). Total cost of credit: £120. Total amount payable: £720. Monthly loan payment: £50. Representative 83.1% APR

CashLady Representative 79.5% APR

What length of loan term does Creditspring offer?

Creditspring only offers loans over a six-month period. This means that the greater the loan amount, the higher the monthly repayments will be as there is no option to spread a larger loan amount over a longer term.

Can I repay my loan early?

Yes, you can repay your loan in full before the end of the six-month term if you wish to do so, however, as the loans are interest free there is no direct financial benefit to repaying early.

Will there be any fees if I am late to make a payment?

There are no late fees. However, you will need to notify the Creditspring customer service team five working days before your payment is due if you want to arrange a new repayment date.

If you miss or are late in making either your membership fee payment or your loan repayments, this will be reported to at least one of the credit reference agencies. This will harm your credit score and could make it more difficult to borrow in the future.

How can I apply for a Creditspring loan?

You can use Creditspring’s free eligibility checker to see which tier of membership you are eligible for. This will affect the loan amount which you are able to borrow.

Typically, to be accepted, Creditspring requires you:

- Must be a UK resident

- Must be at least 18 years old

- Have a minimum income of £14,000 per year

- Must not have any recent County Court Judgements (CCJs) or have been previously bankrupt.

Once you have completed the short application form, you will receive an outcome in less than 60 seconds. To complete your application, a hard credit check must be carried out.

Customer service contact details

Creditspring can be contacted via phone on 020 3870 3332 or via post at:

1st Floor South (Office A),

75 Davies Street,

LONDON,

W1K 5JN

The customer contact centre is open from Monday to Friday between the hours of 9am to 5pm. Creditspring is closed at weekends and Bank Holidays.

Creditspring customers can also get in touch via an online form at a time convenient to them. These forms can be used to raise general enquiries, payments queries and complaints.

Is there an app for Creditspring?

There is no app for Creditspring currently.

How is Creditspring regulated?

Creditspring is a trading name of Inclusive Finance Limited. Inclusive Finance Limited are authorised and regulated by the Financial Conduct Authority (FCA). Their FCA register number is 786052.

What do customers think of Creditspring?

As of August 2024, Creditspring has been rated 4.8 out of 5 on average by thousands of customers on Trustpilot.

A summary of Creditspring

Creditspring offer interest-free loans as part of their membership package, which is subject to a monthly fee.

Members can access two loans per year. The amount that can be borrowed will depend on the customer’s individual circumstances and is subject to a hard credit check.

Each loan must be repaid in monthly instalments over a six-month period. Creditspring do not allow their customers to vary the loan term.

Creditspring is rated Excellent on Trustpilot which has been derived as an average from over 13,000 real customer reviews (as of August 2024).