How much can I apply to borrow?

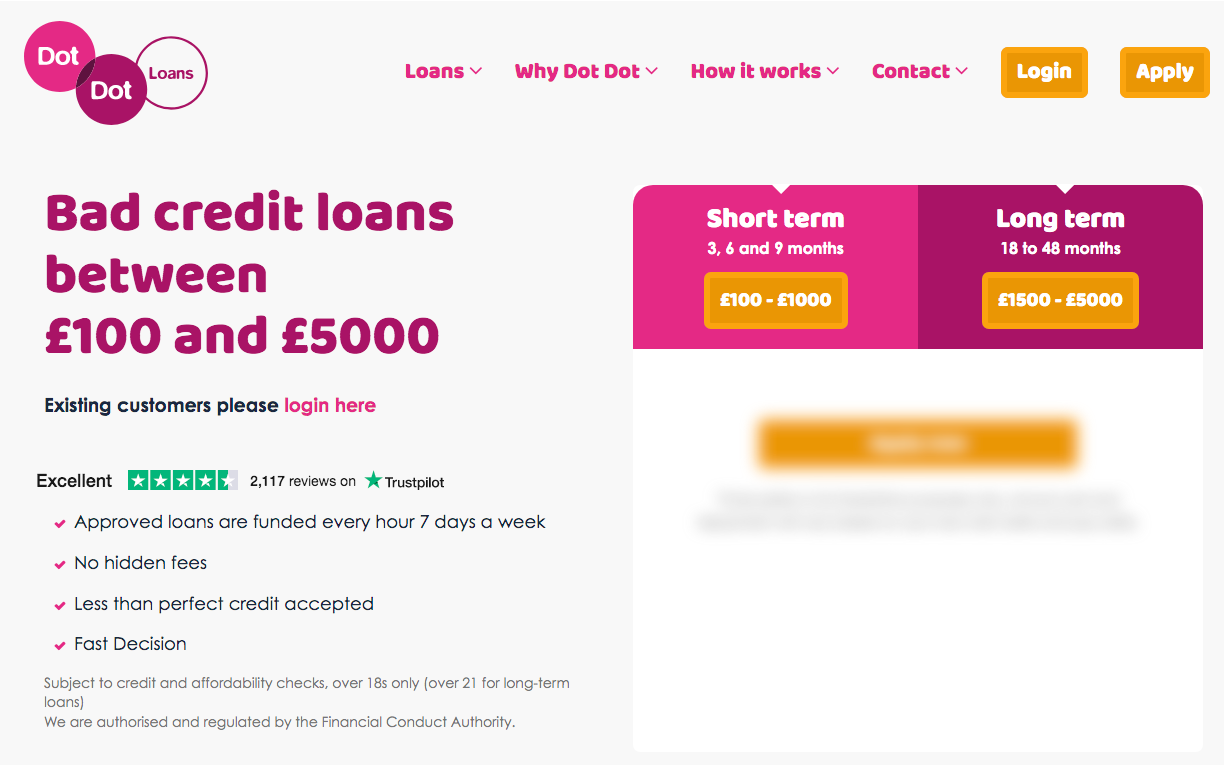

Dot Dot Loans offers short-term loans from £100 to £1000, repayable over 3, 6 or 9 months, with a Representative 1228.67% APR. (if you qualify).

How soon do I have to repay the loan?

Dot Dot Loans offer repayment schedules of either 3, 6 or 9 months for thier short term loans.

What sort of interest should I expect to repay?

Dot Dot Loans have a Representative APR of 1228.67% and a fixed interest rate of 284.76% per annum.

For example, if you wish to Borrow £250 over 3 months, each monthly repayment will be £133.65, with a total amount payable £400.95.

The best way to calculate how much interest you would pay is to use the calculator on the Dot Dot website here.

CashLady Representative 79.5% APR

How quickly will I receive the money?

Loans that are approved are funded every hour. This is available 24 hours per day, 7 days per week.

Are there any late payment fees?

Dot Dot Loans say you will not be charged for any missed or late payments.

Can I repay a Dot Dot Loan early?

Yes, you need to contact the customer service team who will tell you the amount that needs to be paid. No initial mention is made of additional fees or costs. You may also be entitled to a rebate of interest.

How do I apply for a Dot Dot Loan?

The only limitations placed on applying for a Dot Dot Loan is that you have to be:

- Aged 18 years or over

- A full UK resident

- Currently in employment (no mention of minimum income is made)

- Valid email address and working mobile number

The application is made online, and Dot Dot Loans will ask for further details related to expenditure, outgoing and bank account information. They will also use a system called ‘Open Banking’ to check the activity of your bank account via an API.

Are Dot Dot Loans authorised and regulated by the Financial Conduct Authority (FCA)?

Yes, they can be found on the FCA register under Shelby Finance Ltd and have been authorised to by the FCA since 30/3/16.

How can I contact Dot Dot Loans’ customer service team?

You can call 0333 240 6215, Monday to Friday 9am to 6pm, and Saturday 9am to 1pm.

No direct email address is available, but you can send a message via their Contact Us page.

Can I see Dot Dot Loans on social media?

The company has no presence on X but you can view their facebook page here.

How do they fare with customer reviews?

Dot Dot Loans have an ‘Great’ rating on Trustpilot, with 3.9/5 from 2,175 reviews, which is correct as of November 2023.

Do Dot Dot Loans offer an online account?

You can manage your loan via their online portal, where you can keep on top of your scheduled instalments and also make payments.

Dot Dot Loans summary

Dot Dot Loans provide short-term and personal loans to consumers and have been active since 2017.

The representative APR for their short term loans is 1228.6% and has a maximum loan amount of £1,000.

Loans agreed before 3pm will ensure the money is sent the same day, with anything after that time taking place the next day.

Dot Dot Loans do not charge for missed payments. You have the option to repay early and you may also be able to claim a rebate on interest.

To apply for a Dot Dot loan you must be:

- At least 18 years old

- A UK resident

- In part-time or full-time employment

- The owner of a working mobile number and email address

The company has a positive rating on Trustpilot of 4.6/5 and are authorised & regulated by the FCA under Shelby Finance Ltd.